Bestseller’s AI Wholesale Bet, OneOff’s “Spotify for Fashion,” and Tariffs' Ongoing Impact

Bestseller debuts Hypedrop to design via real-time data; OneOff fuses AI and influencer commerce; U.S. tariffs continue to disrupt textile economies from India to Vietnam.

Bestseller Launches Hypedrop, Its AI-Driven Wholesale Platform

The Danish fashion giant Bestseller has introduced Hypedrop, an AI-powered wholesale platform that designs products based on real-time market signals. Drawing on trend data and supplier feedback, the system generates photorealistic visuals and video mock-ups, enabling Bestseller’s creative teams to refine and release on-trend designs with far shorter lead times. The group, which owns brands such as Jack & Jones, Vero Moda, and Only, claims the tool can cut retailer turnaround to six weeks while maintaining traditional margin ratios.

Why it matters: Hypedrop signals a major step toward data-driven, on-demand production in mainstream fashion. By replacing sampling and aligning manufacturing with actual market demand, Bestseller aims to reduce waste, avoid overproduction, and give wholesale buyers the kind of agility once reserved for fast-fashion e-commerce.

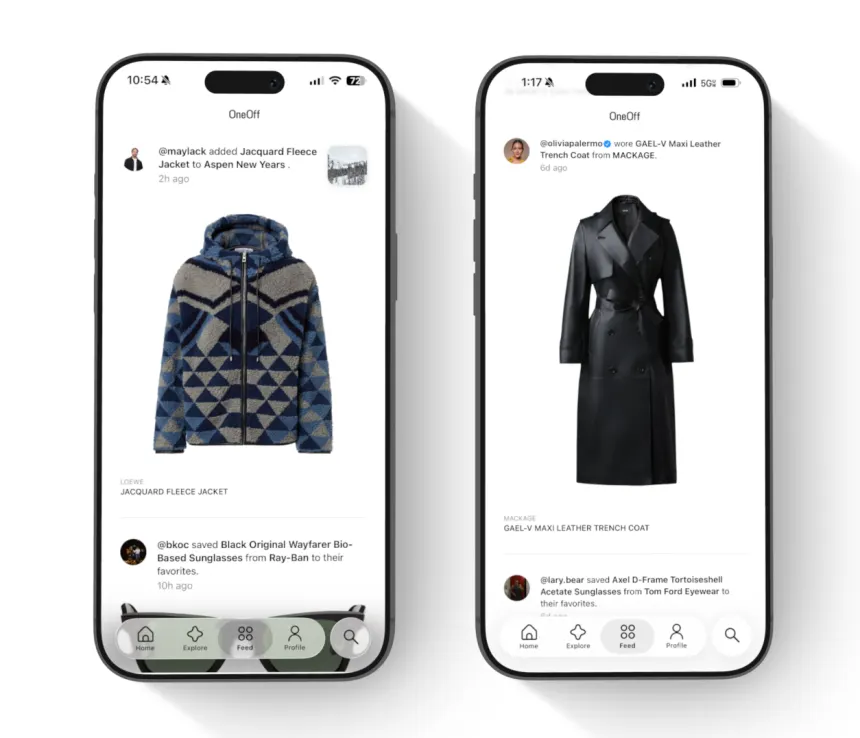

OneOff Aims to Be the Spotify of Fashion

Startup OneOff has launched an AI-powered shopping app that lets users browse, identify, and buy outfits worn by celebrities and influencers. Founded by former Cameo creative chief Bobby Maylack, the platform scans paparazzi photos and social posts to build shoppable feeds featuring styles from names like Emma Chamberlain, Winnie Harlow, and Quavo. It aggregates over one million SKUs from Ssense, Net-a-Porter, Revolve, and more, offering a unified checkout and personalized discovery experience that blends social browsing with e-commerce.

Why it matters: OneOff is quietly building a new data layer for fashion discovery. By combining AI image recognition with affiliate commerce, it’s creating feedback loops between celebrity influence, retail inventory, and consumer behaviour. That’s potentially powerful for brands and retailers, who gain real-time insight into what drives style adoption.

Tariffs Continue to Upend Global Fashion Supply Chains

A 50% U.S. tariff on Indian goods has frozen production across India’s textile belt, where 45 million workers depend on apparel exports (paywall). Gap, Zara, H&M, and Primark are pulling orders as denim and cotton shipments collapse 40%, erasing decades of poverty reduction fueled by fast-fashion manufacturing. Vietnam, Nike’s largest sourcing hub, faces similar turmoil under new 20-40% tariffs, threatening $25 billion in exports. Even Lesotho, once a model for Africa’s AGOA-driven garment boom, has declared an economic “state of disaster.”

Why it matters: Tariffs on low-margin products like clothing don’t just raise U.S. prices, they reverse the globalization engine that lifted millions out of poverty. As brands reroute sourcing, the fragile progress of export-led economies hangs in the balance, exposing how deeply fashion’s supply chains remain tied to political volatility.

Quick Links

Other stories that caught our eye.